What you can do if mortgage rates drop after locking | Is my interest rate locked? | Can it change before closing? | Questions to ask your lender

Mortgage rates fluctuate daily — sometimes hourly. From the moment you apply for a mortgage to the day you finally close, interest rates can change immensely — and not always downward.

To protect you from rising interest rates, lenders will offer a mortgage rate lock.

Essentially, you're guaranteed to have the same interest rate from the day you applied or got preapproved for as long as it takes to process your mortgage, or 30 to 60 days. Even if interest rates skyrocket during this period, your locked interest rate will be protected.

» SAVE: Find your agent through Clever Real Estate, get cash back savings when you buy!

What happens if mortgage rates drop after locking?

When interest rates go up, your rate lock can feel like a blessing: you’re guaranteed the lower rate. But if rates fall, your lender won’t automatically lower your rate to match.

You have only two options to snag the lowest interest rates:

Buy a float-down lock when you apply

With a float-down lock, your lender will adjust downward if interest rates drop. So you'll get protection from rising rates, but you won’t miss out if rates start to creep down.

For instance, if you lock in for 5%, but rates plummet to 4.25% at closing, a float-down would give you the lowest of the two.

Of course, float-downs come with additional costs. You’ll pay around 0.5–1.0% of your loan amount for a float-down option, or between $1,500 and $3,000 on a $300,000 mortgage.

And your float-down rate won’t kick in until interest rates change past a certain threshold, usually 25 percentage points below your locked-in rate — say, a drop from 3.00% to 2.75%.

If you expect rates to drop significantly during the mortgage process, the extra costs of adding a float-down lock might be worth it.

| ⚡️ Quick Tip: Finding a buyer's agent is a good first step!Connecting with an experienced local agent is a good way to kickstart your home buying process. Agents can help you set a budget and recommend trusted lenders so you can compare rates, get preapproved, and start touring houses.

We recommend trying out Clever Real Estate’s free agent matching service. Clever matches you with the best local buyers agents with no obligation. And you can qualify for cash back — that’s money back on a $400,000 home purchase! Learn More. |

Switch lenders

You can always cancel your loan application and switch lenders. If you find a new lender before rates fluctuate upward, you can lock in the lower rate.

But depending on how far you are in the loan process, switching lenders can trigger some expensive consequences:

💸 A new lender will require another home appraisal ($300–450) and another credit check (about 5 points for most hard inquiries).

💸 Your old lender may also refuse to return your earnest money, which could mean losing thousands of dollars.

You’ll also spend time going through the mortgage process again. That's not ideal if you’re trying to close quickly.

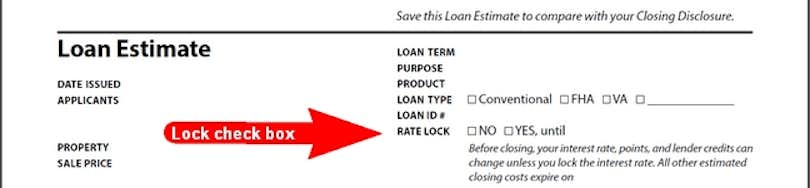

How do I know if my interest rate is locked?

The federal government requires lenders to disclose whether the interest rate is "locked" on the loan estimate form. Your lender will inform you of whether the interest rate is locked or not, and you can find documentation in the upper-right corner of your loan estimate.

Can my interest rate change before closing?

A rate-lock protects you from rising interest rates. But if your circumstances change, lenders still retain the right to adjust your rate. The main reasons for raising your interest rate before closing include:

- Your home appraised for lower than your lender was expecting.

- There was a major change on your credit report, such as missing a payment or a new loan.

- You switched your type of loan, for example, from an FHA loan to a conventional mortgage.

- Your lender couldn’t verify a source of income.

The lender must notify you of the new rate at least three business days before changing it. You have the right to cancel the application if you disagree with the rate change.

Questions to ask your lender about rate locks

When shopping for an interest rate, ask each lender about the current interest rate, mortgage points (if any), loan terms, and what they would do if your rate lock expires BEFORE you close on your home.

🤔 Other questions you might want to ask a potential mortgage lender include:

Can you change your interest rate after you lock in?

Most lenders will not readjust the interest rate after locking your rate. Your best options may be to buy a float-down lock ahead of time or switch lenders.

How long will the rate lock last?

Lenders will typically lock rates based on the time they think it will take to process your mortgage application, or around 30 to 60 days. If your application takes longer than this, lenders may extend the lock period for a fee.

How much does a rate lock cost?

While most lenders don't charge for an interest rate lock, some charge around 0.25–0.59% of the loan amount for a rate lock of up to 60 days.

What happens when the rate lock expires?

If your rate lock expires before your mortgage application has been fully processed, your lender can start a new rate lock period. If rates have gone up since you first applied, your lender will likely give you a higher interest rate. If rates have fallen or stayed the same, you’ll likely get the same locked-in rate.

When can you lock in a mortgage rate?

Some lenders lock interest rates after you’re pre-approved. Others wait until the actual loan application is submitted. So always ask your lender when they lock in rates — BEFORE you apply.